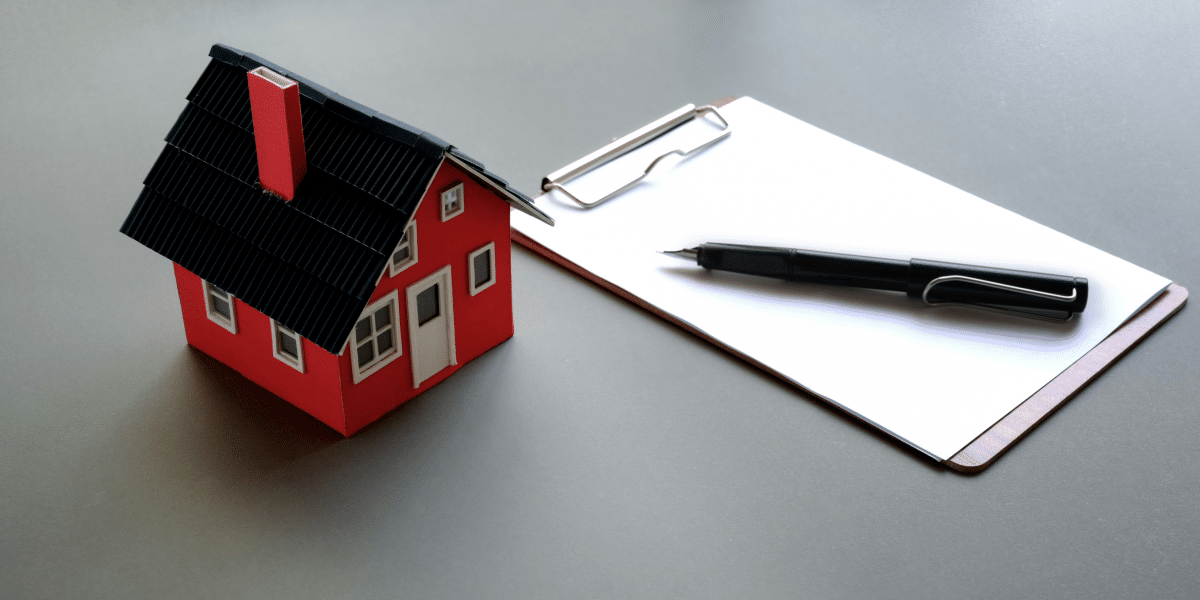

Planning a wedding is a journey filled with excitement, dreams, and detailed arrangements. But while you’re envisioning the perfect day, securing the premier wedding insurance in the UK will help provide peace of mind. In this guide, we’ll explore how wedding insurance works, why it’s essential, and what to look for when choosing the right policy for your big day.

Why Wedding Insurance Matters

Your wedding is more than a celebration—it’s an investment. With the average wedding cost climbing, protecting that investment becomes crucial. Wedding insurance offers a safety net against unforeseen events that could impact your special day, including cancellations, supplier issues, and liability claims. Whether it’s for wedding rings, the dress, or your reception venue, having the right coverage can make all the difference.

What Does Wedding Insurance Cover?

Wedding insurance policies typically offer a range of coverage options, helping protect against potential disruptions. Here are some core areas covered:

- Cancellation Cover: This safeguards you if your wedding day must be postponed due to illness, injury, or other unexpected events. With the premier wedding insurance providers, you may secure financial protection if circumstances force you to delay or cancel your wedding.

- Wedding Suppliers: Supplier failure is a common concern. If a wedding supplier fails to deliver—be it the caterer, florist, or photographer—wedding insurance will help recover the expenses, allowing you to make alternative arrangements without additional stress.

- Wedding Attire and Rings: Insurance for items like wedding attire and rings helps ensure that lost, stolen, or damaged items can be replaced. The coverage extends to engagement rings, wedding rings, and even ceremonial attire, safeguarding these valuable elements.

- Public and Personal Liability: Liability insurance covers you and your wedding party for potential accidents or property damage during the event. With guests, family members, and vendors at the reception, public liability coverage will provide essential protection.

- Marquee and Equipment Cover: For weddings held outdoors or in marquee tents, marquee cover is available. The type of coverage protects rented equipment from damage, technical faults, or weather-related incidents.

- Financial Failure: If a wedding supplier unexpectedly goes out of business, wedding insurance will cover the financial failure, helping you secure replacements without incurring additional costs.

Choosing the Right Wedding Insurance Policy

Finding the right wedding insurance policy depends on your unique needs. Factors to consider include the location of your wedding, the size of your guest list, and the total wedding budget. Here are some tips to guide you:

- Evaluate Coverage Limits: Coverage limits vary among wedding insurance providers, so review these carefully. Make sure your policy covers high-ticket items like the wedding dress, wedding rings, and reception venue.

- Understand Exclusions: Each policy has exclusions. For instance, most wedding insurance policies don’t cover pre-existing medical conditions unless specified. Carefully read the small print to understand what is and isn’t included.

- Check for Add-Ons: Many wedding insurers offer optional add-ons, such as coverage for engagement rings, ceremonial swords, or even table centerpieces. If these items are part of your wedding, ensure they are covered.

- Review the Claims Process: In case you need to file a claim, the process should be straightforward. Look for insurance providers with clear instructions and efficient customer service. Policies under the Financial Services Compensation Scheme may offer extra reassurance if the insurer faces financial trouble.

Key Benefits of Wedding Insurance

Wedding insurance provides financial protection for various unexpected events. Here are the main benefits:

- Peace of Mind: With wedding insurance, you may plan your day without the stress of unforeseen mishaps. If a supplier fails or a key member of the wedding party is unable to attend, cancellation cover and supplier failure protection offer security.

- Legal Expenses Coverage: Some wedding insurance policies include coverage for legal expenses if disputes arise with suppliers. The benefit will be invaluable when handling contractual disagreements or liability issues.

- Coverage for Travel and Accommodation: If you’re hosting a destination wedding, certain policies may include travel insurance, covering additional costs if you need to reschedule flights, hotels, or other reservations.

- Special Event Insurance: Weddings are special events with unique needs. From liability coverage to loss or damage protection, wedding insurance is tailored to safeguard everything from the ceremony to the reception.

Comparing Wedding Insurance Providers in the UK

When looking for the premier wedding insurance UK options, consider companies with a track record in wedding cover. Popular choices often include Dreamsaver Wedding Insurance and other trusted names, each offering a range of coverage and premium options to suit various budgets. Requesting a wedding insurance quote online will help you find the policy that aligns with your needs and wedding costs.

Understanding Wedding Insurance Costs

Wedding insurance cost varies based on the level of coverage, your location, and the chosen policy. Basic policies may be affordable, covering essentials like wedding attire and liability, while more comprehensive packages with add-ons and higher limits will be priced accordingly. Remember that the insurance premium tax may apply to your policy, which is common in financial services.

Common Exclusions and Considerations

While wedding insurance provides extensive coverage, it’s essential to note what it doesn’t cover:

- Pre-Existing Conditions: Most policies exclude coverage for pre-existing conditions unless specifically stated.

- Intentional Acts: Damages caused intentionally are typically not covered.

- Stolen or Damaged Items Without a Written Agreement: If rented items like marquee tents or ceremonial attire are stolen or damaged, a written agreement may be required for a successful claim.

Making the Most of Your Coverage

Once you buy wedding insurance, take a few extra steps to ensure smooth coverage. Keep all receipts and contracts with wedding suppliers, as these documents are essential during the claims process. It’s also a good idea to review your policy as your wedding date approaches, ensuring all key aspects are covered.

Final Thoughts: Finding the Premier Wedding Insurance UK

Choosing suitable wedding insurance in the UK can provide added peace of mind for your special day. With coverage options ranging from cancellation to personal liability, the right policy can help you manage potential challenges. Whether it’s a large celebration or an intimate gathering, wedding insurance supports a smoother experience, allowing you to focus on the moments that matter.

Frequently Asked Questions

What does wedding insurance typically cover at a wedding venue?

Standard wedding insurance policies often cover costs related to unforeseen damages or cancellations at your wedding venue.

Does wedding insurance protect wedding gifts?

Many wedding insurance policies include coverage for lost, stolen, or damaged wedding gifts.

Can wedding insurance cover the wedding ceremony?

Yes, standard wedding insurance policies usually cover issues that could impact your wedding ceremony, such as cancellations due to severe weather or illness.

Disclaimer: This content is intended for informational purposes only and should not be taken as financial, investment, or professional advice. It does not replace guidance from a licensed financial advisor or other qualified professional. Before making any financial decisions, readers are encouraged to consult with a certified expert to ensure choices align with their unique needs and circumstances.

Published by: Martin De Juan